“How to pay international employees quickly, cost-saving, and legally” is a popular question when a company starts a broad global business. You should decide on five factors: hiring, employee working time, payment tool, local law, and budget. Discover the details to get practical steps and ways to pay!

5 Steps to Pay International Employees

There are five steps to send a payment for your global employee. Take the straightforward guide below:

- Step 1: Decide the hiring method. There are three ways to hire an international employee. Firstly, you can open a legal entity in their country and hire them as a local business. The second method is cooperating with an employer of record (EOR) partner. The last choice is to hire yours with independent contracts. Don’t skip the next section to get details!

- Step 2: Classify your employees properly. It means separating the types of work, such as full-time workers, part-time employees, contractors, etc. Estimating the company’s needs to hire the exact number is necessary.

- Step 3: Choose a payment method. There are multiple payment ways to consider. It’s up to you to use a third-party partner, an international wallet, or pay them directly.

- Step 4: Get to know local laws. Each country has a specific rule about working, hiring, and paying internationally. By comprehending it, you can avoid legal troubles.

- Step 5: Set your budget. It is vital to estimate how much you will spend on paying international employees. This step ensures running a “healthy” business.

6 Ways to Pay International Employees

Consider paying international employees through one of the popular methods below. Get to know each way’s advantages, disadvantages, and step-by-step guidelines here.

Use an Employer of Record (EOR).

An Employer of Record (often known as EOR) is a third-party service that helps your recruitment, manages payroll, pays taxes, and provides all the essential benefits for international employees in the country that you want to hire. You don’t need to open your local entity in those countries.

The advantage of cooperating with an EOR:

- Avoid potential legacy risks: They are experts in hiring internationally. So, they understand working laws in both the employee’s country and yours to make the contract legally.

- Save time: It is very time-consuming to learn everything about the requirements of the countries you target to hire. The trial and error process also takes you a lot of time. An EOR can handle and solve problems fast and effectively.

- Save cost: You don’t have to invest in building new HR members and establishing local businesses using independent contractors.

The process is finding an appropriate EOR partner, stating your needs, and paying for the service. However, it would be best to clarify that EORs aren’t responsible for managing the employee’s daily tasks. Consider working with an EOR if you have a limit on a budget or human resources.

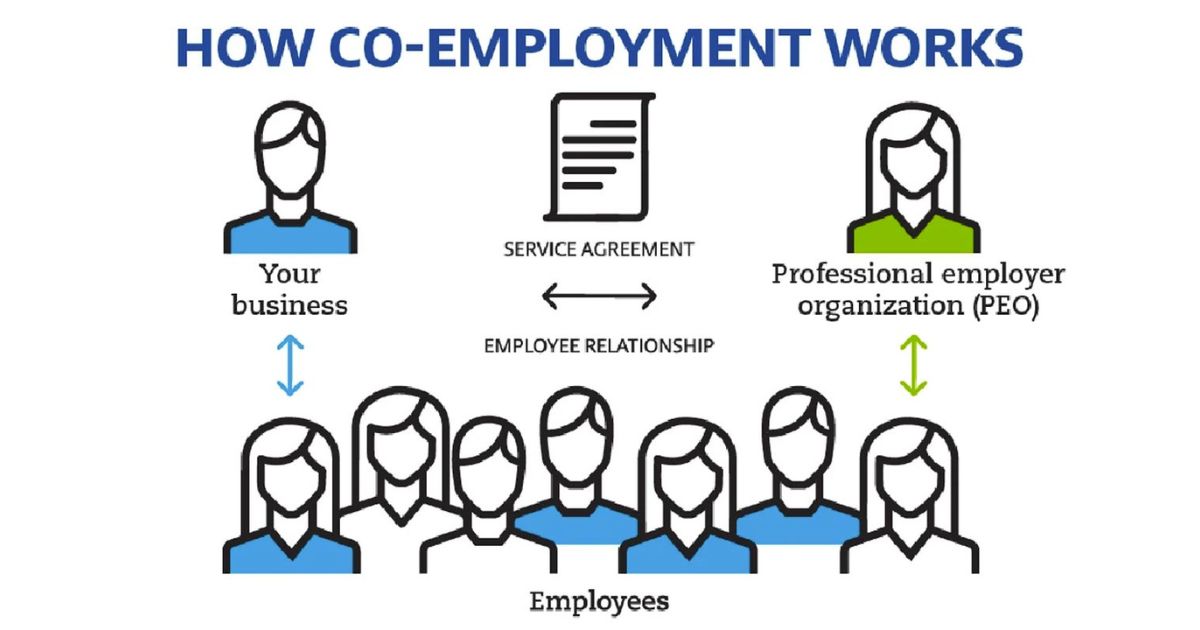

Engage the Services of a PEO

A Professional Employer Organization (PEO) also manages all HR tasks as an Employer of Record (EOR) does. The difference is you need to open an entity where the employee lives. Choosing a PEO is much more affordable and faster for paying international employees if you have an available entity or plan to open an entity in the future.

Register a Local Legal Entity Abroad

It’s worth registering a local legal entity when you want to hire at least 25 employees in a country. Moreover, it can bring many advantages to implementing market expansion strategies in those countries.

Here are three steps to register one remotely.

- Step 1: Understand the country’s laws: In Vietnam, it is essential to learn the conditions for establishing, the way to get a business license, bank accounts, taxes requirements, and labor law.

- Step 2: Choose a type of business: Which kind of company would you like to establish: a representative office, branch, or foreign entity?

- Step 3: Log in to register your business: The most important thing is to prepare all the legal documents that the foreign country requires. They might include an address, business document, a local manager or representative, a local bank and tax accounts, a payroll system, etc.

A representative one is easy to set up but impossible to employ sales, engineers, etc. A branch office costs more money and time. At the same time, a foreign subsidiary allows you to recruit as a local business. Consider paying international employees with the most suitable partner.

Choose Online Payment Service Providers

Using online payment service providers, you can manage the global payroll. These payment services will transfer the currency automatically and send them to employees with a charge. They are simple, fast, safe, and legal.

Here are the four most popular international payment services for you:

- Wise: pay employees in over 50 countries without cash.

- PayPal: reach 203 global markets without the hassle of converting currency.

- Payoneer: send payment without requiring a merchant account.

- SWIFT: pay through banks. It often has a slower transfer and higher charge but high security.

Pay Through a Third-party Employer

Compared with a PEO or EOR, a third-party employer only takes responsibility for sending employee salaries when your company requires it. This partner will transfer your currency into the employees’. It is essential to make clear that a third-party employer and staffing agency won’t recruit or calculate tax, insurance, and other benefits.

There are some vital criteria for choosing an excellent global payroll partner, including

- The local entity in the countries you are hiring

- The legal expertise you need

- Having the ability to handle both contractors and employees on the same platform

- The affordable charge for commission, onboarding, etc.

Pay Workers as Independent Contractors

Using this method, it’s up to you to decide on an appropriate type of contract with your international employees. There are many types of agreements:

- Temporary or permanent

- Part-time or full-time

Understanding the labor laws in both countries is to avoid misclassification and dispute. Be careful to add terms and conditions, including

- Benefits: salary, insurance, payment time, overtime rate, etc.

- Details: working hours, working days, obligations to the company, safety guidelines, tax, etc.

What Should Companies Consider When Having Overseas Payroll?

When companies have employees working outside the country, you must consider a few important things. For starters, the company should tackle the essentials below:

- Choose the proper recruiting and paying method to avoid paying new taxes or double taxation in both countries. Cooperating with an EOR is the best way to ensure the legacy and avoid excessive taxation.

- Understand labor laws in each country, including tax submission deadlines, specific required documents, calculating tax for businesses and employees, etc.

- Optimize the international payroll process to enhance the working experience for employees. It is worth updating local requirements, accurately calculating employee benefits, completing periodic reports, and optimizing the process.

- Find the best ways to reduce costs. It does not mean reducing salary or benefits for international employees. You can make use of the tax treaties between countries, work with low-fee platforms or partners, and simplify the payroll process.

FAQs

Is it legal to work remotely from another country?

It is legal to work remotely when you have a visa and work permit. However, some might not allow their residents to work for businesses in some specific areas.

Can a US company employ and pay someone in another country?

The answer is Yes. A US business can recruit and pay for international employees in another country, including Vietnam. However, the process is often more complicated than hiring laborers in the US. You need to manage more tasks such as payroll, local tax, a local entity, etc.

Do international employees pay taxes?

Most international employees must pay taxes. However, the rate and way to calculate it are different among countries. Therefore, you must learn about them carefully before your company hires laborers abroad.

Learning how to pay international employees is relatively easy. However, it is time-consuming. Choosing the right hiring strategy, managing payroll, and understanding local laws are essential. ERA hopes you will successfully hire high-quality international employees.

See more related articles:

Best Employer Of Record Benefits Company

Best EOR Companies To Ensure Compliance

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.