Have you known how to pay taxes for independent contractors yet? Independent contractors may be an excellent method to swiftly scale up your operations by leveraging exceptional skills. However, many people need help paying taxes for this kind of contractor in Vietnam. Because employers have to withhold or pay taxes for foreign workers, paying independent contractors is typically more challenging and expensive than paying employees. In this post, let’s walk through 6 easy steps to pay independent contractors.

Who Can Be An Independent Contractor In Vietnam?

Anyone, including citizens and non-residents, can participate in freelance employment in Vietnam. However, the conditions for each are different. Non-residents must get a work visa to work in Vietnam lawfully.

Tourist visa holders are not permitted to work in Vietnam (for companies in Vietnam). Tourist visas are valid for three months. Yet, because of the difficult circumstances caused by the COVID-19 outbreak, Vietnam has temporarily delayed the application for new tourist visas. A foreigner must obtain a work visa to operate as a freelancer in Vietnam (with Vietnamese firms or individuals).

There is still a solution. Independent contractors who work online are not required to get a work visa. For example, a worker from China visiting Vietnam for a few months and working remotely for a Chinese company can operate privately without paying taxes in Vietnam or getting a work visa.

How to Fill Taxes in Vietnam as a Contractor

In Vietnam, your employer usually is responsible for your income taxes. Therefore, knowing contract payment with taxes in Vietnam with these three easy steps below will be a good advantage for foreign freelancers:

Step 1: Obtain a Federal Tax Identification Number

Please provide the following papers to your employer:

- A copy of your legitimate identity card/citizen identification (for Vietnamese citizens); or

- A copy of your current passport (for individuals of foreign nationality).

Your information will be included in a consolidated tax registration form (Form No. 05-DK-TH-TCT) and submitted to the local tax office by your employer. You will be given a personal tax identification number within three working days of the tax office receiving your tax registration file.

Step 2: Keep a Record of Income Tax Withheld

Your employer withholds employment income taxes. You can also decide to declare and pay your taxes.

Suppose the tax withheld in the first month is less than VND50 million. In that case, your employers must file a monthly or quarterly tax declaration and an annual tax finalization report on your taxable employment income. They should complete this process by the 20th of the following month and 90 days after the end of the fiscal year.

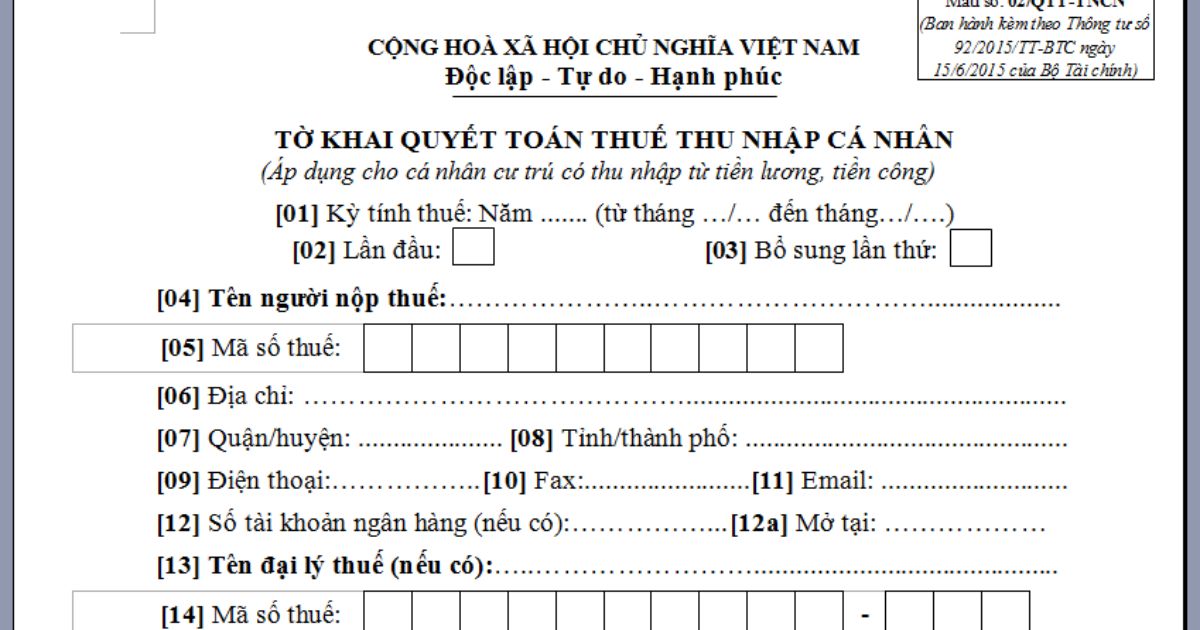

Step 3: File Tax Finalization Declare Form

If you have many sources of income and your tax due at the end of the year is greater or less than the total amount of tax paid throughout the year, you must submit a tax finalization declaration form (Form No. 2 / QTT-TNCN).

Individuals must file a tax return and pay their final bill by March 30, after the assessment year.

How To Pay Taxes In Vietnam?

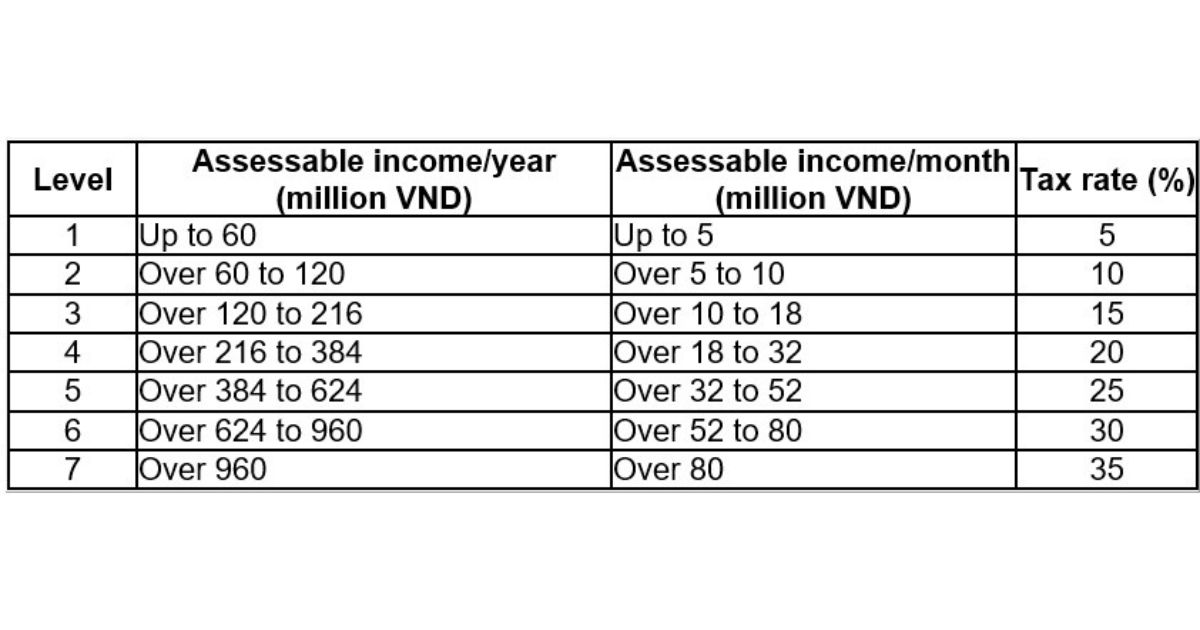

Suppose you are a tax resident freelancing in Vietnam. In that case, your hiring firm or employer will assist you in finalizing your PIT (Personal Income Tax) and deducting it instantly from your income.

If you pay taxes in your country, you must present a certificate from your country to confirm that you have done so.

If you are a Vietnamese who works as an independent contractor in Vietnam, you must file your taxes on time or pay monthly taxes. There are two options for paying your tax:

- Cash payment

- Transfer by bank

You must pay taxes directly to the state treasury and will be given a tax voucher as confirmation that you have paid your taxes.

Laws For Hiring Independent Contractors?

Independent contractors are not employees but are hired by employers to do specific activities under a service agreement with a company. The Civil Code controls the service agreement; no employment relationship is created between the parties, so they are not subject to labor restrictions.

Companies that sign service agreements with independent contractors may need help to demand fixed work hours or full-time commitments. Depending on the terms of the deal, an independent contractor may or may not be compelled to perform their work on the company’s premises.

Companies are also not required to provide independent contractors with statutory leave, severance pay, or job-loss payment if the service agreement is terminated. Independent contractors are not required to participate in statutory social, health, or unemployment insurance, meaning businesses are not required to contribute to social security funds.

To prevent a possible issue of interpreting such an agreement as a labor contract, the terms and wording of the service contract should be explicit so that it is not regarded as an employment contract by the contractor and a third party or governmental authorities.

Frequently Asked Questions

Are independent contractors considered a payroll expense?

No, they are not considered payroll expenses. Because employers are not obligated to deduct taxes on payments made to independent contractors, they may regard them as business costs rather than payroll expenses.

What are the challenges of managing independent contractors?

- Invoice collection and processing

- Compliance with local labor regulations

- Managing tax obligations and appropriate tax forms

- reducing the possibility of misclassification

How do I know if a worker is a contractor or an employee?

Employees who work for a corporation receive salary and bonuses for adhering to the organization’s policies and remaining loyal. Meanwhile, a contractor is self-employed with independence and freedom but doesn’t get health insurance or paid time off benefits.

Conclusion

As you can see, not only contractor payroll but taxes in Vietnam are also two of the essential things foreign independent contractors need to know as carefully as possible to succeed in this country. This article has shown you all steps how to pay taxes for independent contractors and necessary laws that independent contractors need to know when working in Vietnam.

See more related articles:

How much do independent contractors pay in taxes

How To File Taxes As An Independent Contractor?

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.