Many think “freelance” and “self-employed” are interchangeable without knowing they still have notable differences. Although both involve working independently, these two jobs still differ in customer base, nature of work, commitment, etc. In this article, ERA will help you distinguish freelance vs self-employed.

Who Is A Freelancer?

A freelancer is an independent contractor who provides services to various organizations and businesses. They need a signed contract to perform the work. Although freelancers work under contract for companies and organizations, they are ultimately self-employed.

Freelancers agree to a predetermined fee based on the time, skill, and effort required to complete the task. This fee can be flat, hourly, per day, or project.

Typically, freelancers work in creative, skilled, or service sectors. Some instances of freelance roles include the following:

- Writing

- Marketing

- Developer

- Graphic design

- Website development

- Consulting and advising

- Photography

- Tutoring

- Data analysis

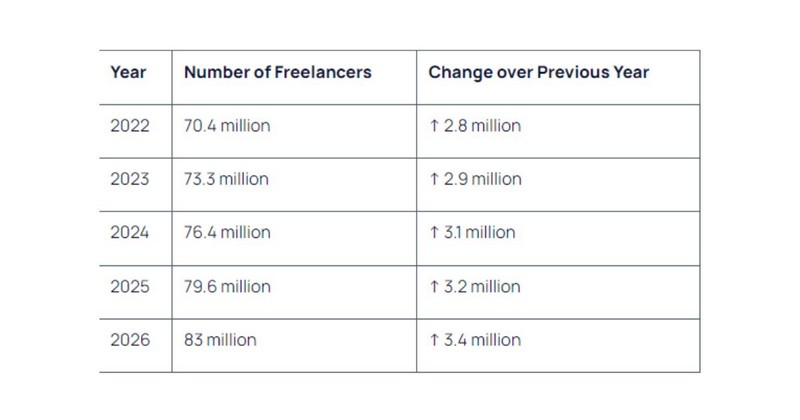

Exploding Topics estimates there will be 76.4 million freelancers in the United States in 2024. Many specialists predict that by 2028, there will be more than 90 million freelancers in America.

Freelancers tend to work on short-term contracts and sometimes long-term ones. Depending on their schedule, they often take on multiple projects simultaneously.

Although freelancers are self-employed individuals, what makes them different is that they work on assignments from their clients. They often work independently to satisfy client requirements, get feedback, and adhere to project rules.

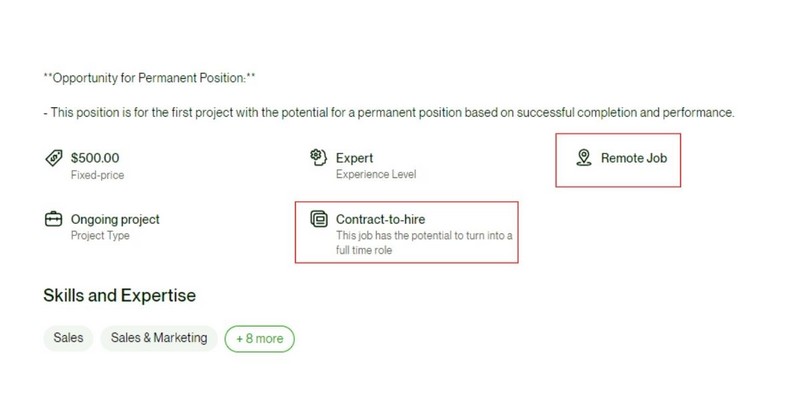

You can find freelance jobs through word of mouth, referrals, and networking. Besides, many online platforms, such as UpWork, LinkedIn, and Fiverr, are popular places to find freelance work.

Who Is A Self-Employed Person?

A self-employed person establishes their own legal company rather than working for an employer or organization. They have complete authority over their work hours, duties, and methods.

Unlike traditional jobs, self-employed workers do not receive automatic benefits. Additionally, they must prepare work necessities themselves, although they may benefit from various tax deductions to reduce their taxable income.

The Current Population Survey reveals about 16.5 million self-employed people in the United States. This number represents approximately 10.4% of the working population, but some sources reveal that the number may be even higher.

Zippia has calculated the salary of a self-employed person in the US from reliable data sources. The answer is that they earn an average of $84,305 a year or about $40.53 per hour.

Examples of self-employment are:

- Business owners

- Sales professionals

- Skilled tradespeople

- Investors

- Legal professionals

- Performers

There are 3 main types of self-employment:

- Independent contractors are individuals hired for specific tasks and paid only for completed work. Clients don’t withhold taxes from payments.

- Sole proprietorships are those who own and operate businesses. They can hire a few employees yet take full responsibility for losses and receive all profits.

- Partnership is a cooperative agreement between two or more individuals who jointly manage and profit from a business.

Freelancer Vs. Self-Employed Worker: 2 Similarities

Both freelancers and self-employed workers have similarities that can lead to initial confusion between the two. There are two key parallels:

Independence

Freelancers and self-employed individuals enjoy a greater level of independence than regular employees. They can make work-related decisions, choose collaborators, and adjust their schedules accordingly. In addition, they can control their processes whether they are freelance or self-employed.

A great thing about these jobs is that they can take on multiple clients or projects at the same time, using their skills and knowledge in various ways. This flexibility allows them to explore different opportunities and expand their experience across different fields.

Whether writing, graphic design, data analysis, or any other service, freelancers and self-employed workers can maximize their talent and expertise.

For example, a freelance writer has complete control over the choice and arrangement of words in their publishes. A self-employed individual has full autonomy in managing the logistical aspects of their business.

In contrast, regular employees lack this level of independence because their managers assign them tasks. They must follow the employer’s instructions to complete them.

Taxes

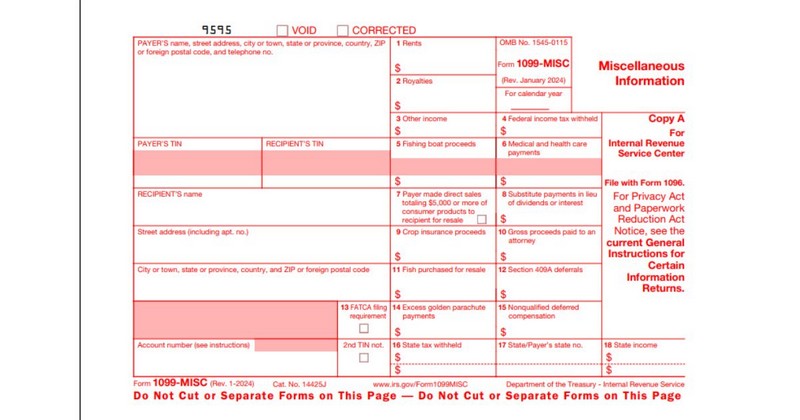

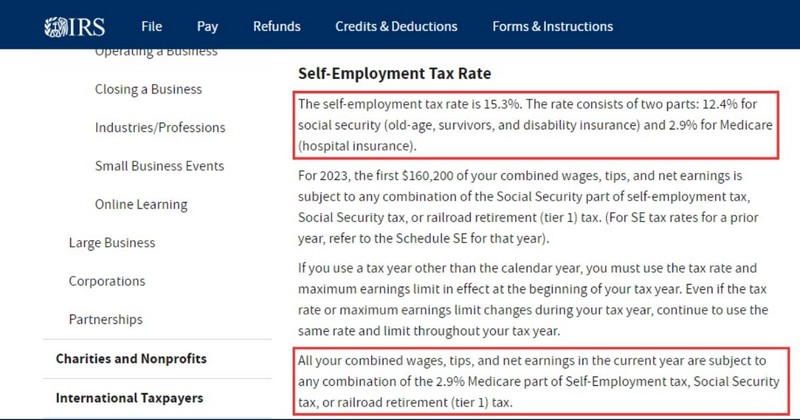

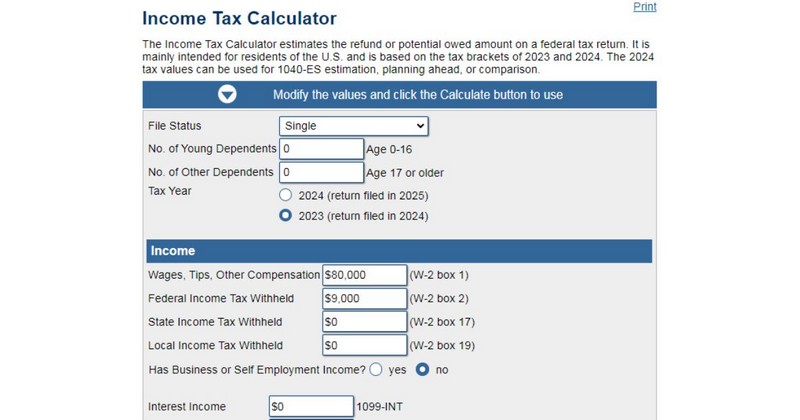

For both freelance and self-employed employees, managing taxes is an important responsibility. The Internal Revenue Service (IRS) considers freelancers self-employed workers for 1099 tax filing purposes, meaning you are accountable for filing and paying your taxes.

In most cases, freelancers will pay two types of taxes: income tax and self-employment tax.

You are responsible for paying self-employment taxes if you earn $400 or more from the freelance job in any year. These estimated payments are due on April 15, June 15, September 15, and January 15 of the following year.

Remember, you must report any freelance income you earn on your tax return and pay income tax on all of it.

Self-employed individuals must pay FICA taxes, including Social Security and Medicare taxes. Unlike W-2 employees, who typically require employers to pay half of FICA taxes, self-employed individuals must pay the entire 15.3%. This number includes 12.4% for Social Security and 2.9% for Medicare.

As self-employed, you can deduct a portion of your taxes as if you were the employer. This deduction helps reduce your taxable income for income tax purposes. However, it does not affect how much you earn from self-employment or the total self-employment tax you owe.

Use a tax calculator or contact us to simplify tax calculations. Staying informed about tax deadlines and obligations is essential to ensuring compliance with IRS regulations.

Self-Employed Vs. Freelance: 6 Differences

Besides the similarities mentioned above, what is the difference between freelance and self-employed? Here is the answer:

| Aspect | Freelancers | Self-Employed Individuals |

| Nature of Work | Often work independently on solo projects. | Often have a team supporting business operations. |

| Objective & Approach | Work on a project basis, focusing on building shorter-term relationships. | Operate organizations with a defined structure, prioritizing brand building and seeking long-term success. |

| Work Autonomy | Have some control over choosing clients but must comply with client requirements. | Enjoy greater autonomy to customize offerings and adapt to market conditions. |

| Schedule Flexibility | Have high flexibility in work schedules and location. | Have more limited schedules and may need to adhere to set hours. |

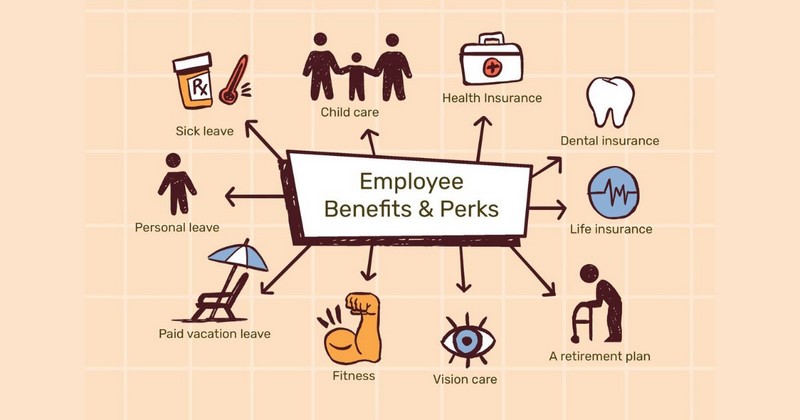

| Employment Benefits | Not receive traditional benefits, responsible for sourcing and funding their benefits. | More flexible in sourcing and managing benefits, can create customized packages aligned with their goals. |

Nature Of Work

- Freelancers often work independently on solo projects.

- Self-employed people often have a team of workers supporting their business operations.

This difference is not only due to financial constraints but also because self-employed individuals often use an entrepreneurial approach. While freelancers try to provide diverse services to different clients, self-employed individuals focus on building a company or brand. Therefore, people who want to expand their business or run a larger business often need support from others.

Objective and Approach

- Freelancers often work on a project basis. They can consider this a full-time or side job to supplement a full-time job to set a suitable schedule. With a focus on completing tasks and receiving fees, freelancers often have shorter-term relationships with clients.

- Self-employed individuals often operate organizations with a defined operating structure. They prioritize building and marketing their brand and seeking opportunities such as investors, funding, and other strategies to scale their businesses and achieve long-term success.

Work Autonomy

Although freelancers and self-employed workers have a degree of independence, their levels of control and autonomy vary:

- Freelancers have some control over choosing their clients. However, after accepting the job, they still must comply with the customer’s specialized requirements, progress, and deadline. They provide services according to customer preferences and demands.

- Self-employed individuals enjoy greater autonomy. They have more flexibility to customize their offerings, test different approaches, and adapt to changing market conditions without being constrained by individual customer preferences.

Thus, although both groups work independently, the level of autonomy is a major difference between freelance and self-employed.

Schedule Flexibility

- Freelancers have a high degree of flexibility in their work schedules. Although they must meet deadlines, they can choose when to do so within those limits. Their work location is also often flexible: a home office, a co-working space, or remotely from anywhere with an Internet connection.

- Self-employed workers have more limited work schedules, depending on the nature of their business. If they run a company with a physical office, they may need to adhere to set opening and closing hours. In addition, they have fewer options for business locations than freelancers.

Employment Benefits

Another difference between self-employed and freelance is employment benefits:

- Freelancers often do not receive traditional employee benefits, including paid leave, health insurance, retirement contributions, and other perks. Since freelancers are considered independent contractors, they are responsible for sourcing and funding their benefits.

- Self-employed people are more flexible in sourcing and managing these benefits. They can explore various health insurance options and have access to retirement savings plans like the SEP or Solo 401(k), allowing them to save for retirement with potential tax benefits.

Besides, self-employed individuals can create customized benefits packages that suit their needs and preferences. It includes allocating funds for paid time off, life insurance, disability insurance, and more benefits that align with their goals.

The Bottom Line

In conclusion, both freelancers and self-employed workers play crucial roles in the workforce. However, it’s critical to recognize the differences in how they work, the structure of their job, and the benefits they receive. If you have more questions about freelance vs. self-employed, contact ERA, and we will be ready to help you.

Frequently Asked Questions

What are gig workers?

In recent years, the concept of gig work, gig workers, and the gig economy in general have received more attention. The term “gig worker” refers to people who take jobs through app-based digital platforms such as Uber, DoorDash, or TaskRabbit.

Is it better to say freelance or self-employed on resumes?

You should emphasize your experience on your resume without explicitly stating “self-employed” or “self-work.” Instead, choose strong descriptions like “Contractor,” “Consultant,” or “Freelancer” to express your independence and expertise convincingly.

Can I freelance if I am employed?

Yes, you can freelance when working for a small or large company. However, you need to verify with your employer whether this is under the terms of your contract. Additionally, consider and resolve any potential conflicts of interest or ethical issues that may arise.

See more related articles:

Freelance vs Consultant: What Are The Differences?