In recent years, freelancers and self-employed contractors have become some of the most popular job positions among the younger generation. As of 2024, Upwork had over 18 million registered freelancers, making it the biggest platform for freelancers.

Understanding the difference between a Freelancer vs Self-Employed Contractor, ERA will help people distinguish each responsibility and role in business and, hence, make better decisions when choosing their future jobs.

Who Is A Freelancer?

A freelancer is a person who offers their services to companies or people on an as-needed basis. They are responsible for tasks or projects requiring a specific timeframe, like writing articles, taking pictures, or designing business logos. These services are usually not recurring, allowing them to be completed by a freelancer.

For example, a freelance photographer offers his expertise in taking portraits, weddings, and event photos for his clients. Additional services like photo editing may be charged an extra cost, which will be discussed through a contract agreement between both parties.

They can work with clients in the short term, like for a single event, or build a longer-term relationship with them through a contract.

Freelancers may work on a contract basis or full-time as a side job. They also require signed contracts to be independent contractors.

The payment also depends on freelancers’ earning money based on their time, skills, and effort to complete the task. Many people work as freelancers because they enjoy choosing various projects from the clients and working flexible hours. They can set their hours and work when they are productive. Some work full-time on weekdays and part-time on weekends.

Depending on the income tax laws of different countries, freelancers also take responsibility for paying their self-employment taxes.

For example, freelancers must pay income and self-employment taxes in the USA. The self-employment tax is 15.3% of freelance income and covers their Social Security and Medicare taxes.

Who Is An Independent Contractor?

A contractor usually engages in contractual tasks as an external worker, potentially as a self-employed individual. Traditionally, an independent contractor is formally employed by a vendor or agency, working under their management and receiving periodic payments.

However, in contemporary usage, the term often denotes skilled professionals who offer specialized services, operate their businesses, and work independently rather than through an agency.

For example, an independent contractor can be a consultant in various fields, such as HR, marketing, etc., who provides expert advice and services to businesses on a contract basis. Lawyers can also work independently to serve clients without being part of a more prominent firm.

The rise of the gig economy (short-term and flexible jobs) has led to an increase in independent contractors. Data from the US Bureau of Labor Statistics showed that 15% of all workers are independent contractors.

Furthermore, job benefits like health insurance and employer-sponsored retirement plans are not provided to independent contractors. Therefore, they must pay their own Medicare and Social Security taxes.

They can set their hours and availability and keep track of their earnings and client payments.

They also pay self-employment taxes for Social Security and Medicare. Independent contractors pay 2.9% of Medicare taxes on all net income and 12.4% of Social Security contributions on the first $168,600 net income in the United States (2024).

A Freelancer And A Contractor: What Are The Differences?

Becoming a freelancer or independent contractor can help you develop your career and choose different clients and projects. Knowing the similarities and differences between independent contractors and freelancers can help you find what suits you.

Key takeaway

| Aspect | Freelancer | Independent Contractor |

| Project Scope and Client Base | Their relationship is relatively less formalShort-term and limited scope | Their relationship with the client is more traditional. Longer-term and more scope |

| Control and Expertise | Have more autonomy in their work | Accept jobs with longer time frames |

| Business Management and Benefits | Not having a formal business | Established a legal business structure |

| Setting rates | Set their rates depending on their jobs | Work on an hourly or project-based rate |

| Work Location | Typically work remotely. | May need to work on-site. |

Project Scope And Client Base

Freelancers take on short-term and limited scope. Their different clients often bring a new set of demands and deadlines with each project.

Independent contractors often manage longer-term contracts with many clients and provide ongoing consulting, marketing support, or song composition services.

Companies often hire independent contractors to utilize their expertise for a specific project.

Control And Expertise

Freelancers typically operate with more autonomy and control over their work. They have specialized skills in a particular field and often work on a project-by-project basis, providing services to multiple clients simultaneously.

Freelancers can set their schedules, choose the projects they want to work on and determine their rates. While clients may provide guidelines or expectations for the project, freelancers retain a significant degree of independence in executing the work.

On the other hand, contractors are often hired for extended periods and are subject to more oversight and direction from the contracting company. Unlike freelancers, contractors are typically engaged for specific durations or milestones within a project and may work exclusively for one client at a time.

While contractors also possess specialized skills and expertise, they often operate within the framework established by the contracting company, following specific guidelines, deadlines, and reporting structures.

Legal Structure

Freelancers might need a formal business entity, but they undertake projects under individual contracts. Therefore, they are responsible for managing their own taxes and business expenses.

On the other hand, companies or agencies hire Independent contractors to provide specific services without being considered official employees. Often, these companies or agencies will handle the contractors’ work’s legal aspects and tax obligations.

Setting Rates

Freelancers must establish pricing structures, choosing hourly, daily, or project-based rates. They’re also accountable for negotiating rates with clients, initiating payment requests, and overseeing invoice management.

In contrast, contractors, typically engaged through agencies, have rates determined and communicated by the agency to clients. Nevertheless, certain contractors, like freelancers, operate independently and are responsible for setting their rates and managing invoicing autonomously.

Choosing A Work Location

Freelancers take control of where they work. It’s like working anywhere at any time.

Independent contractors who work for only one client at a time. So they can negotiate their work location for each project. Many companies require independent contractors to be on-site to use company tools. Sometimes, they might work in their client’s office or remotely.

Freelancers Vs Contractors: 4 Things To Consider When Hiring

From project scope and legal aspects, these are 4 factors individuals or organizations must consider when hiring freelancers or independent contractors:

| Areas of distinction | Freelancers | Independent contractors |

| Project Scope and Control | They prefer doing short-term projects. They are good at specific tasks and offer fresh perspectives. They use their tools and manage their work schedules. Clients just provide guidelines, clear instructions, and deadlines. | They are well-suited for longer-term projects with ongoing needs. They can adapt to changing requirements, giving clients more control over their daily tasks. The hiring party may be involved in setting project methods to ensure consistency. |

| Expertise and Supervision | They manage their own time and require minimal supervision. You need clear communication to ensure project alignment. | May possess broader skill sets applicable to your industry. They can work independently but might require collaboration with your team. |

| Cost and Benefits | Generally charge hourly or per-project rates. You avoid employee benefits and overhead costs. However, you need to manage multiple freelancers for complex projects. | It may be more expensive due to longer engagements. You might be responsible for benefits depending on the contract. |

| Flexibility | They are known for their flexibility. They often work with many clients at once. You need to adapt their schedules to meet various project deadlines. This flexibility can benefit clients who need quick, temporary assistance. | They can also be flexible but are involved in long-term projects and serve limited clients. |

Decide on freelancers or contractors based on project scope and legal factors.

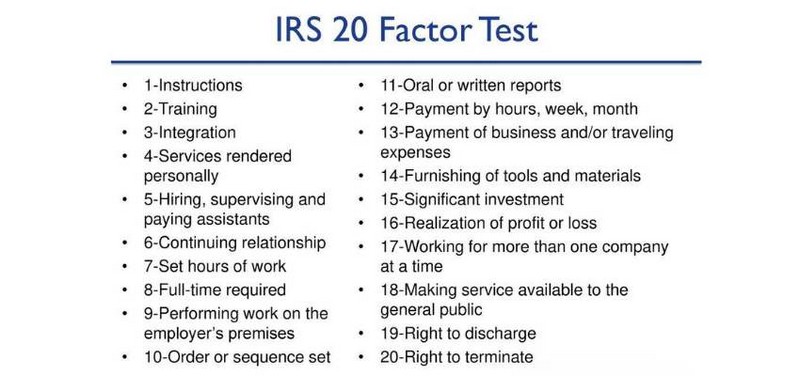

How Does The IRS Evaluate Employee Classification?

The Internal Revenue Service (IRS) designed a key system called the Evaluation for Worker Classification in the United States. This system helps distinguish whether someone you hire is an employee or an independent contractor.

When deciding whether a person works for a company or independently, the IRS applies common law principles. It involves federal unemployment taxes, Social Security and Medicare FICA taxes, and federal income taxes. The IRS is primarily concerned with:

- Behavioral control: Who controls your work hours and where you work (office, home, etc.)?

- Financial control: Who manages your salary, deductions, and work-related expenses?

- Relationship control: Does your employer offer benefits and determine the length of your employment (contract, temporary, etc.)?

The IRS uses this specific 20-question test to determine worker status:

- Actual instruction or direction of the worker

- Training

- Combining services

- Personal nature of services

- Similar workers

- Continuing relationship

- Hours of work

- Full-time work

- Work on the premises

- Order of performance

- Submitting reports

- Method of payment

- Payment of expenses

- Tools and materials

- Investment

- Profit or loss

- Exclusivity of work

- Available to the general public

- Right of discharge

- Right to quit

Conclusion

In conclusion, when considering “Freelancer vs Contractor,” it’s important to understand the differences between the two. A freelancer usually works independently on various projects, while a contractor typically works for a specific company for a set period. Both have advantages, and it’s essential to choose the one that best fits your needs and situation.

Frequent Ask Question

What Is The Difference Between A Contractor And A Freelancer?

The main differences between freelancers and contractors are project scope and client bases:

- Project Scope: Freelancers handle shorter-term projects with many clients simultaneously, while independent contractors take on longer-term projects with ongoing needs.

- Client Base: Freelancers juggle multiple clients at once. They have the flexibility to choose projects that suit their skills and interests. However, independent contractors often work with a single client at a time, dedicating most of their working hours to that project.

Is Freelance A Type Of Contract?

Freelancing is a work style in which someone takes on many projects for different clients. They do not work for a single company with a regular salary. They might agree to a contract to define the details with a client.

What Is The Difference Between Self-Employed And Freelance?

Both “freelance” and “self-employed” mean you don’t work for a regular company with a boss. A freelancer works on specific jobs for clients, like writing or design.

They might work on a website for one client and then take photos for another. It’s like having lots of mini-jobs. On the other hand, “self-employed” covers anyone who runs their own business, no matter what they do

Is A Freelancer The Same As A Subcontractor?

They are different. After receiving clear instructions and deadlines, they use their tools to help their clients’ workload. For example, a freelance web designer assisting with website reviews, copywriting, or SEO falls into this category.

Subcontractors specialize in areas outside their clients’ expertise and often need to be supervised. Hiring a subcontractor for legal advice or complex coding falls into this category.

See more related articles

What Is Contractor Compliance?

What Is Contractor Compliance?

Understanding Contractor Workers’ Compensation

Contractor vs Subcontractor: How To Differentiate?

Consultant vs Contractor: 4 Fundamental Differences

Difference Between Vendor vs Contractor: What Should Employers Know?