An independent contractor is someone who performs tasks for a business but has control over the process of accomplishing those tasks. The government must file additional documents to avoid any legal charges related to tax for the independent contractor, such as contract work tax or personal tax income. They are assigned individual tax responsibilities and must be responsible themselves.

Most independent contractors find it challenging and time-consuming. This article is a complete tax guide on how to file taxes as an independent contractor.

What Is An Independent Contractor?

An independent contractor is a self-employed or small business owner that provides services to another individual or organization. These authorities have a right to control the result of your tasks, not the work process. Independent contractors are freelancers and gig workers such as attorneys and accountants.

Independent contractors do not classify as employees. Therefore, they can work as sole proprietors, limited liability companies (LLC), or S-corporations. However, they have to be responsible for their independent contractor taxes, including contract work or personal income tax, which seems complex.

How To File Taxes as an Independent Contractor In Vietnam?

In accordance with the rules, filing taxes as an independent contractor is challenging. It is the worker’s responsibility to complete additional forms and submit estimated tax payments regularly.

In Vietnam, Clause 1, Article 25 of Circular 111/2013/TT-BTC, if independent workers who do not sign labor contracts and receive a total income of two million (2,000,000) VND/time or more will deduct 10% independent contractor taxes as personal income tax.

When filing taxes as an independent contractor, prepare one set of tax registration documents for taxpayers subject to personal income tax payment. Tax tips for independent contractors specified in Clause 9 Article 7 of Circular 95/2016/TT-BTC dated June 28, 2016, guiding on tax registration, including:

- Tax registration declaration form No. 05-DK-TCT issued together with this Circular;

- A copy that does not require authentication of a valid citizen identification card or people’s identity card.

Based on Article 8 of Circular 95/2016/TT-BTC, after preparing the required documents for tax tips for independent contractors, submit them to the Tax Department where you permanently or temporarily reside.

How to Pay Taxes as an Independent Contractor In Vietnam?

Independent contractors have the obligations to follow the tax regulations from the Vietnam General Department Of Taxation – Ministry Of Finance. Therefore, it requires proper documents to prove and calculate tax from personal salary or any source of income that an independent contractor might have.

Tax Calculation

Organizations and individuals that pay wages, salaries, and other expenses are responsible for withholding tax for independent contractors before paying these individuals. Workers need to multiply the final amount after independent contractor tax deductions. Independent contractors will receive the full salary and calculate the taxes for independent contractors that they have to pay to the Tax Department.

- 10% independent contractor tax deductions. Then, ask the organizations to issue tax withholding documents to finalize tax at the end of the year.

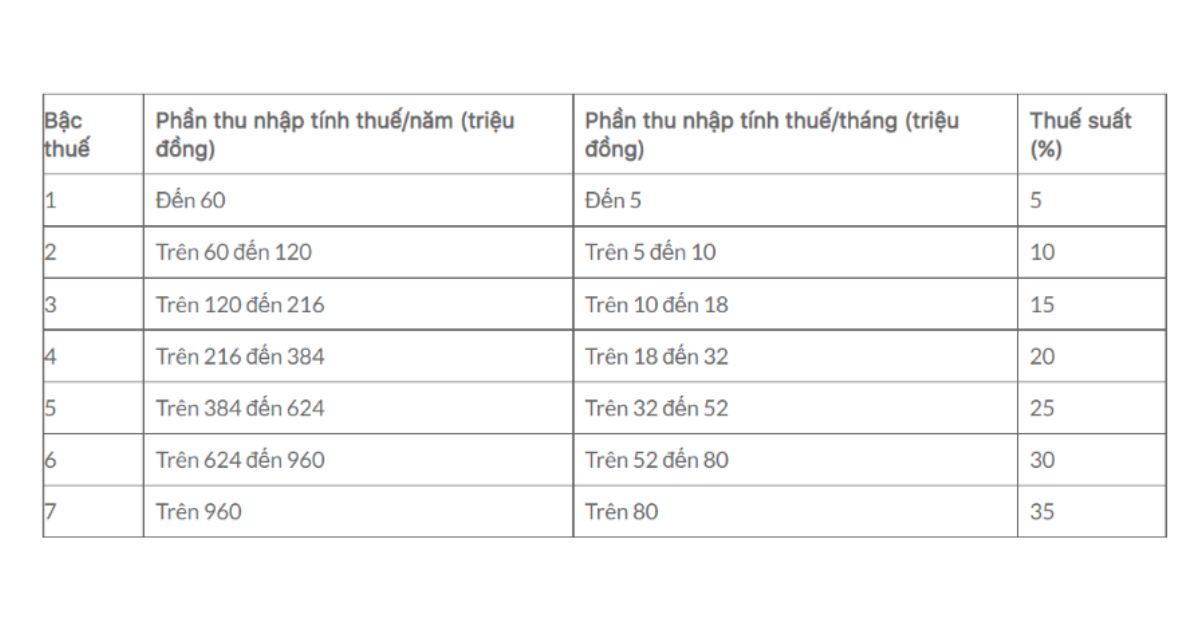

- After deducting personal family circumstances, the salary is 11 million VND/month, and relatives’ is 4,4 million VND/month. The remainder uses for tax calculation according to the progressive tax schedule.

Frequently Asked Questions

Do you pay more in taxes as an independent contractor?

Yes, independent contractors have to pay self-employment tax. This means they must be responsible for employer and employee Medicare and Social Security tax.

How do independent contractors calculate taxable income?

Determine your taxable income after the independent contractor tax deductions. For example, subtract $7,065, which is half of your $14,130 self-employment tax, from your $100,000 earnings. Then take $12,950 away, a standard deduction of tax tips for independent contractors in 2022. You have a remaining taxable income of $79,985.

According to the tax tables for 2022, if your final taxable income is $79,985, the final income of contract work tax is $13,212.

There is an estimated $27,342 in federal taxes after adding the estimated self-employment taxes, $14,130, and estimated federal income taxes, $13,212. Take the final number and divide by 4, your expected quarterly payments are $6,835.50.

Filing taxes as an independent contractor is complex. It requires the worker to do much law research and understand how to calculate it from their annual income. Moreover, since independent contractors are not official employees of any authority, they must be in charge of their tax rolls.

Here is a complete tax guide on how to file taxes as an independent contractor. Each country has different regulations regarding taxes for independent contractors. Therefore, these workers must keep updated with the changes in laws to avoid any legal risks.

Read also: How much do independent contractors pay in taxes

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.